Category: Uncategorized

-

Re-Registration of a Legal Entity (LLC) in Kyrgyzstan in 2025, 2026: Step-by-Step Guide With Online Procedures and Error-Free Execution

•

In 2025, business in Kyrgyzstan is evolving faster than the remaining paper-based bureaucracy. Imagine you run an operating company with stable clients, processes, bank accounts, and signed contracts — and suddenly a strategic partner appears, an investor plans to join, you need to update your legal address, or restructure the…

-

Banking License in Kyrgyzstan: Full Breakdown of Capital Requirements, Regulation, and Market Entry Strategy

•

Imagine you are an international fintech founder tired of slow regulatory processes in large markets — and looking for a jurisdiction where obtaining a banking license is possible while still maintaining real client value: multi-currency accounts, fast cross-border payments, digital integrations, and compliance with global AML standards. In 2025, Kyrgyzstan…

-

Corporate Income Tax in Kyrgyzstan (2025): A Complete Guide for Companies and Non-Residents

•

In 2025, the corporate income tax in the Kyrgyz Republic remains one of the simplest and most competitive in the region. The standard rate stays at 10% for local companies and foreign entities operating through a permanent establishment. This rate is fixed in the Tax Code of the Kyrgyz Republic.…

-

International Banks in Kyrgyzstan: How the Market Works in 2025–2026

•

By 2025, Kyrgyzstan’s banking sector has become significantly more international. The country now has 21 commercial banks and more than 300 branches, including subsidiaries of Turkish and Kazakh financial groups, as well as banks with participation from EBRD, IFC, and the Aga Khan Fund. For foreign entrepreneurs opening a company…

-

Top 20 Business Ideas Kyrgyzstan Lacks in 2026

•

From 2025 to 2026, Kyrgyzstan is steadily transforming from a “quiet economic periphery” into a magnet for IT professionals, fintech startups, and creative entrepreneurs. The government continues simplifying company registration in Kyrgyzstan, cutting taxes for participants of the High Technology Park (HTP) and Creative Industries Park (CIP). Banks are also…

-

Accounting in Kyrgyzstan: Standards, Taxes, and Reporting

•

In 2025, Kyrgyzstan has fully committed to financial transparency and convergence with international accounting standards.A few years ago, accounting was mostly a legal formality. Today, it’s a symbol of trust — between business and government, and between Kyrgyzstan and its international partners. Imagine an entrepreneur who wants to register an…

-

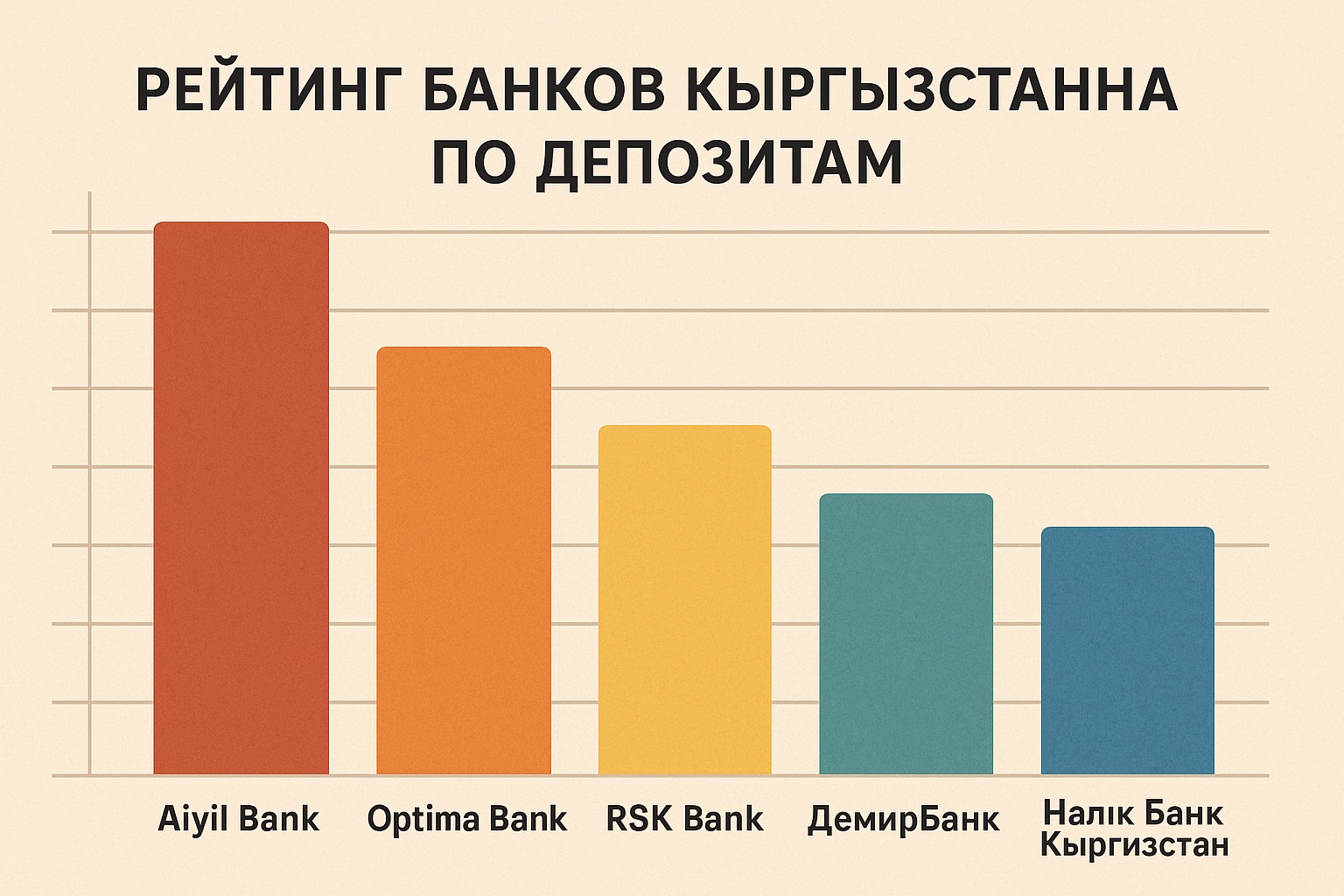

Bank Deposit Rates in Kyrgyzstan (2025)

•

IntroductionIn 2025, Kyrgyzstan’s banking sector is showing remarkable activity. Following a tightening of monetary policy and an increase of the key rate to 9.25% by the National Bank of the Kyrgyz Republic (NBKR), deposits have once again become one of the most popular tools for preserving capital. Imagine you are…

-

Taxes in Kyrgyzstan for Non-Residents in 2025: Rules, Rates, and Nuances for Individuals and Legal Entities

•

In 2025, Kyrgyzstan remains one of the most flexible tax jurisdictions in Central Asia for foreigners. Low taxes in Kyrgyzstan, simplified administration, and the ability to register a company remotely attract both freelancers and international businesses. However, taxation for non-residents is governed by specific provisions that differ from the general…

-

Simplified Tax Regime in Kyrgyzstan (2025)

•

In 2025, Kyrgyzstan finalized a new model for interaction between the state and small businesses.Just five years ago, the national tax system was considered cumbersome — today, entrepreneurs enjoy one of the simplest tax regimes in Eurasia. This is the Simplified Tax Regime (STR) — a framework allowing small and…

-

Licenses in Kyrgyzstan: Overview and Priorities for Foreign Investors

•

Licenses in Kyrgyzstan is the state’s official authorization to conduct specific types of business activity. It serves as a legal tool to safeguard public safety, health, the environment, and national interests. The primary legal framework is the Law of the Kyrgyz Republic “On the Licensing and Permitting System” No. 195…