DTT (Double Tax Treaties) are bilateral tax agreements that prevent double taxation: income earned in one country is not taxed again in the other. These treaties often include reduced tax rates on dividends, interest, and royalties, mechanisms for foreign tax credits, and exemptions for residents from double taxation.

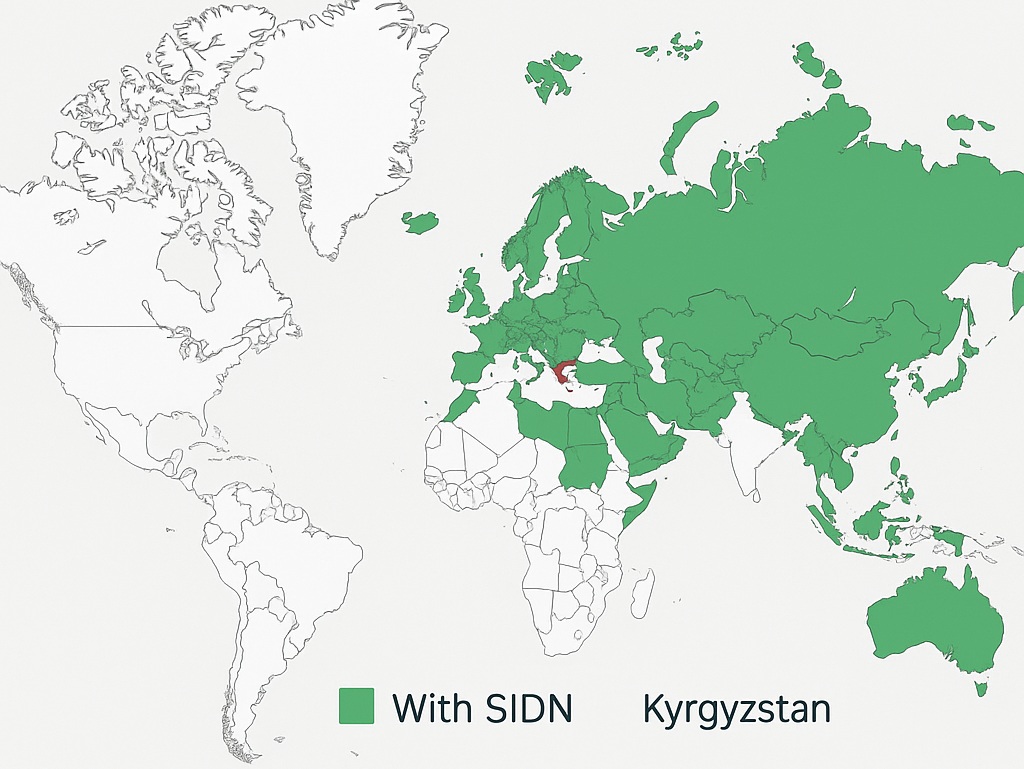

All 34 Countries with Active DTTs

Below is the list of countries with which Kyrgyzstan had effective double taxation treaties as of August 1, 2023:

- Russia

- Kazakhstan

- Belarus

- Ukraine (likely under the CIS treaty)

- Armenia

- Turkey

- China (PRC)

- India

- Iran

- Germany

- Finland

- Austria

- Lithuania

- Moldova

- Mongolia

- Pakistan

- Poland

- France (within Europe)

- Switzerland

- Malaysia

- Hungary

- Canada

- Latvia

- New Zealand

- Saudi Arabia

- Slovakia (to take effect March 1, 2025)

- Singapore

- Kuwait

- Cyprus

- Israel

- South Korea (protocol takes effect July 5, 2025)

- Tajikistan

- Uzbekistan (likely via CIS agreement)

- … (one more country, as the government has not published the complete list in open sources)

This list is based on an official statement by the Ministry of Economy of the Kyrgyz Republic, confirming that 34 bilateral treaties were in force as of the mentioned date.

New Treaties and Changes

- Slovakia: Treaty signed, entering into force March 1, 2025 → total will rise to 35.

- South Korea: Protocol signed on December 3, 2024, entering into force July 5, 2025.

- Negotiations ongoing with the Netherlands, Luxembourg, Cyprus, and others — treaties are at the final stage or under preparation.

Details and Practical Application

Benefits and Rates

DTTs usually establish reduced tax rates on dividends, interest, and royalties, often within 5–10% of the income amount.

Examples of eliminating double taxation

- Under the Russia–Kyrgyzstan DTT, dividends paid by Russian companies to Kyrgyz residents are taxed in Russia at up to 10%, and Kyrgyzstan provides a credit for the tax already paid abroad.

- Similar mechanisms apply to rental income from foreign real estate and capital gains: tax is withheld at the source, with subsequent credit in Kyrgyzstan.

Important! DTTs do not apply to simplified taxation regimes in Kyrgyzstan, such as the Unified Tax.

Example: A Russian citizen registered as an individual entrepreneur in Kyrgyzstan under the Unified Tax at 2% will still be taxed in Russia — 13–15% as an individual, or 6% if they are registered as an IE under the simplified system, or under the patent regime if applicable.

Expected Expansions

Negotiations are underway with the Netherlands, Luxembourg, and Slovakia, with governmental orders issued to ratify the treaties.

How to Claim DTT Benefits

- Submit proof of Kyrgyz tax residency.

- Indicate sources and types of income (dividends, interest, royalties).

- Provide supporting documents from the source country.

- File an application for a reduced rate or foreign tax credit — Kyrgyz tax authorities will apply the exemption or credit under the treaty.

Conclusions

- As of August 1, 2023, Kyrgyzstan had 34 active DTTs with different countries.

- Main partners: CIS, Europe, Asia, and several Middle Eastern states.

- Negotiations are ongoing for expansion, including treaties with the Netherlands, Luxembourg, and Slovakia.

- Applying DTTs reduces the tax burden and avoids double taxation on foreign-sourced income.

- Membership in the HTP (High-Tech Park) or CIP (Creative Industries Park) with a preferential rate (1%) does not exempt from double taxation abroad.