Introduction

In 2025, Kyrgyzstan’s banking sector is showing remarkable activity. Following a tightening of monetary policy and an increase of the key rate to 9.25% by the National Bank of the Kyrgyz Republic (NBKR), deposits have once again become one of the most popular tools for preserving capital. Imagine you are an entrepreneur or freelancer who has just decided to open an LLC in Kyrgyzstan and temporarily place your working capital in a local bank. You’ll face dozens of offers — from large state institutions to private fintech players — and it’s not always clear which bank is more reliable or profitable. This article explores the current deposit rates of Kyrgyz banks in 2025 and helps you make an informed choice.

Deposit Market Trends (2023–2025)

According to the NBKR, the weighted average interest rate on deposits in soms rose to 18.61%. The total volume of household deposits increased by 37%, exceeding 684.9 billion soms.

As noted by Akchabar, competition among banks has shifted toward products with flexible options for replenishment and interest capitalization. Many institutions now offer online deposits to attract not only local clients but also non-residents working remotely — such as IT professionals registered through the High Technology Park (HTP) or Creative Industries Park (CIP).

Bank Deposit Rates in 2025

| Rank | Bank | Avg. Rate (KGS) | Key Features |

|---|---|---|---|

| 1 | Ayil Bank | 12–13% | State-backed, extensive branch network |

| 2 | Mbank | 13–14% | Deposit growth leader, strong mobile app |

| 3 | Bakai Bank | up to 13.5% | “Online Deposit” program, deposit protection |

| 4 | KSB Bank | up to 13.3% | Long-term deposits (24–36 mo.), reliability |

| 5 | Kapital / Dos-Credo / KSSB | up to 15% | Promotional high-yield products |

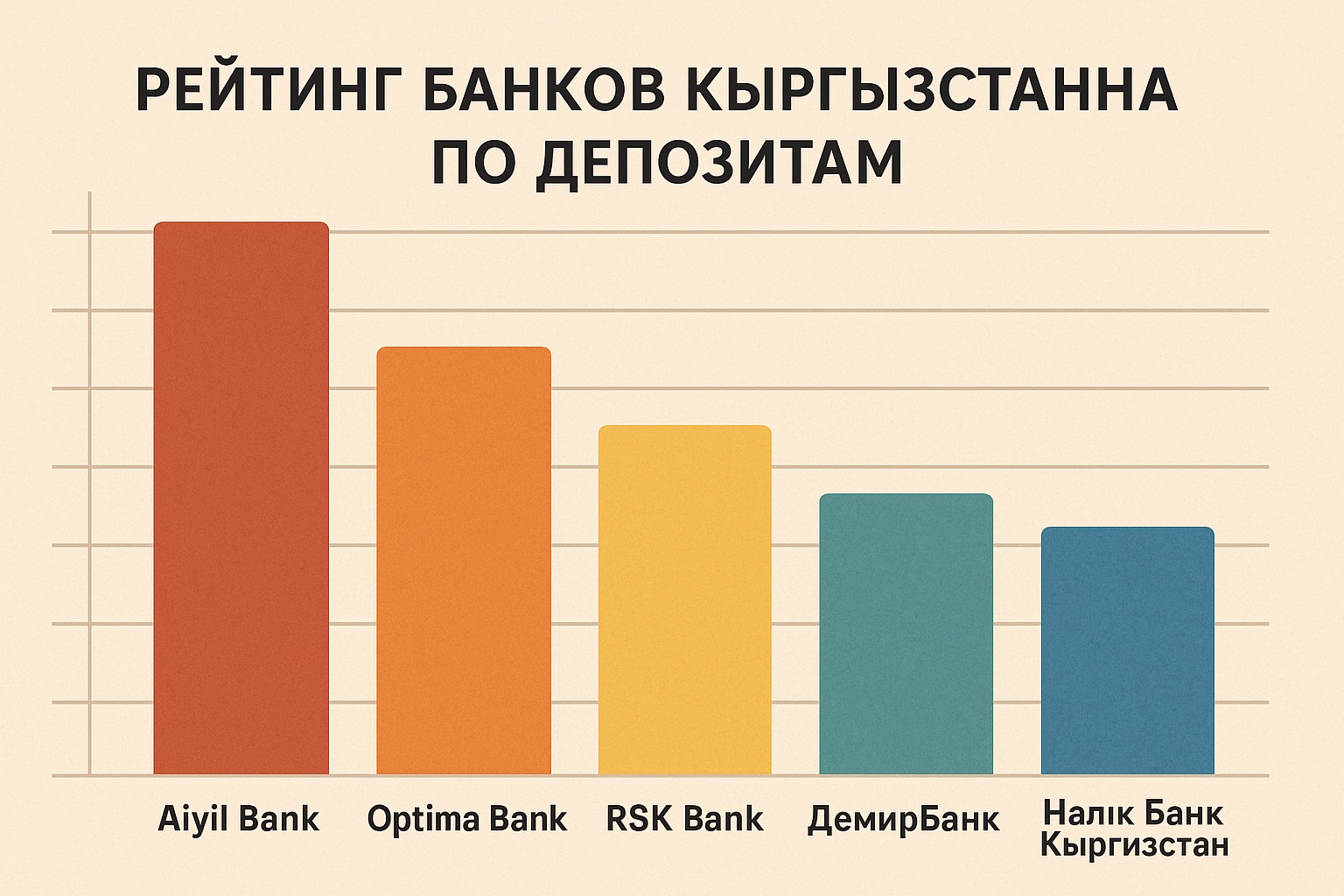

Ayil Bank

According to Economist.kg, Ayil Bank increased its deposit base by 53.9%, reaching 119 billion soms. Thanks to government support and a strong focus on agricultural lending, it remains one of the country’s most stable financial institutions.

Mbank

The fastest-growing bank in terms of deposits, with +61% growth in 2024. Mbank actively expands its digital channels and offers flexible conditions. For foreign clients, it’s one of the few banks where you can open a bank account in Kyrgyzstan with minimal in-person procedures.

Bakai Bank

Offers the “Online Deposit” at up to 13.5% in soms or 8% in USD. A participant in Kyrgyzstan’s deposit protection system, Bakai Bank is ideal for those planning to register a business or place funds remotely.

KSB Bank

A classic and conservative choice, offering up to 13.3% on som deposits. Corporate clients can also open deposits in USD or EUR — a convenient option for companies managing liquidity after registering an IT company.

Kapital, Dos-Credo, and Kyrgyz-Swiss Bank

In 2024–2025, these banks offered the highest yields (up to 14–15% annually). However, most such products come with limits on amount and term.

How to Choose a Deposit in Kyrgyzstan

1. Define your goal and term

If the goal is capital preservation, medium-term deposits (12–24 months) are ideal. For liquidity, short-term deposits (up to 6 months) work best but with lower deposit rates.

2. Choose the currency

KGS deposits offer higher yields but carry inflation risk. For stability, diversify across multiple currencies — a wise choice for companies balancing assets between KGS, USD, and EUR.

3. Check deposit protection

Make sure the bank participates in the Deposit Protection Agency of the Kyrgyz Republic, which guarantees up to 1 million KGS compensation.

4. Review capitalization terms

Some banks add monthly interest to the principal, significantly increasing the real yield — a key factor to consider when selecting long-term deposit options.

FAQ: Common Questions from Depositors

Can non-residents open deposits?

Yes. You’ll need a passport, taxpayer ID, and confirmation of legal status. Choose banks supporting remote identification — convenient for entrepreneurs and freelancers working abroad.

What taxes apply to deposit income?

Under Kyrgyzstan’s Tax Code, the tax on interest income from deposits is 10%, withheld automatically by the bank.

KGS or USD deposits — which are better?

For short-term placements, KGS deposit rates are more profitable; for long-term stability, opt for USD/EUR. The balanced approach is to split your funds between both.

How can a company open a deposit?

Legal entities can open deposits in any bank offering corporate services. The company must have a registered address in Kyrgyzstan and an active corporate account.

Case Study

In 2024, a Portuguese IT company launched its branch in Bishkek via the HTP program. After starting operations, it placed part of its funds ($100,000) in Bakai Bank — 50% in KGS and 50% in USD. Thanks to monthly capitalization and exchange-rate gains, the annual return reached 10.7% in dollar terms.

Key Takeaways

- Ayil Bank and Mbank remain leaders in both volume and deposit growth.

- Bakai Bank and KSB Bank combine reliability with strong interest rates.

- Kapital and Dos-Credo are best for short-term, high-yield promotional deposits.

- For non-residents and expat companies, the optimal choice is a multi-currency deposit and an account in a bank offering remote verification.

- Sectors like fintech and digital services continue to drive banking innovation, supported by programs such as the HTP and CIP.